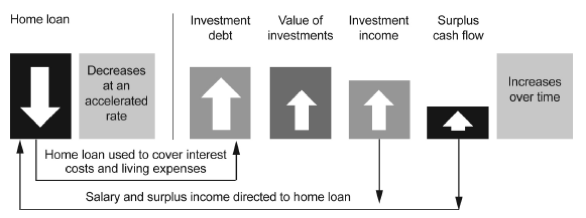

Debt optimisation (sometimes referred to as “Debt Recycling”) is a financial strategy which creates wealth over time and improves an individual’s loan structure. Achieved, in the majority of cases by:

- Using all surplus income to reduce your home loan (non-tax deductible “bad debt”);

- Creating or increasing a separate investment loan (tax deductible “good debt”) by drawing against equity in the home; and

- Using this borrowed money to build an investment portfolio.

It is a great strategy that can be adapted to suit your goals and time horizons. Though, it is important to note that borrowing money to invest and budgeting are key components.

Here is an example of how the assets and cash flow involved in a debt optimisation strategy using a “split loan”:

Where suitable, it is possible to extend on the strategy above by using the newly created investments as security for a margin loan, with the proceeds used for further investments. In this type of strategy the interest costs are still generally paid from the home loan, with investment income also used to reduce the home loan balance.

Your Action Plan

Contact Wise Accountants TODAY on Telephone (08) 8364 3246 for a FREE review of your current loans and advice on whether you would benefit from a Debt Optimisation Strategy!