Depreciation of Property

What is Tax Depreciation and how does it affect my Investment Property?

Tax depreciation (also known as property depreciation) is a legitimate deduction against assessable taxable income, generated by a residential or commercial investment property. It works by allowing property investors to deduct a portion of the original costs of plant and equipment (such as furniture and fittings) and capital works (such as renovations) on their investment property each financial year, over the effective life of that item. The Australian Taxation Office recognises that the value of capital assets gradually reduces over time as they approach the end of their effective life. These assets can be written off as a tax deduction – known as depreciation.

Preparing a Tax Depreciation Schedule

The preparation of a Tax Depreciation Schedule should always include a site inspection where the Quantity Surveyor will take detailed photos and notes documenting sufficient evidence to prepare the report. The report will include a value of each and every qualifying plant and equipment item within the property, the cost of construction at the time the building was built and a projection of the deductions claimable by the owner per financial year over a 40 year period. It is often a surprise to property investors who own an old building to find that property depreciation will attract significant depreciation benefits for both new and old properties. Property owners who have not been claiming depreciation are able to go back and amend previous returns to claim missed deductions in previous financial years.

Is my Property too old to claim Property Depreciation?

The simple answer is no. If your residential property was built after July 1985 you will be able to claim both Building Allowance and Plant and Equipment. If construction on your property commenced prior to this date, you can only claim depreciation on Plant and Equipment. But it will still be worthwhile. Commercial and industrial properties are subject to varying cut off dates.

My Property is renovated. Can I still claim?

Yes. We will need to know how much you spent on renovations. This is an ATO obligation. If the previous owner completed the renovations, you are STILL entitled to claim depreciation. In either case, where the cost of renovation is unknown, a Quantity Surveyor has been identified by the ATO as appropriately qualified to make the estimation.

Case Study

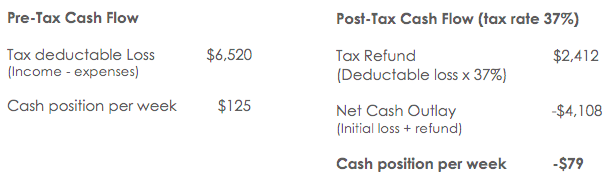

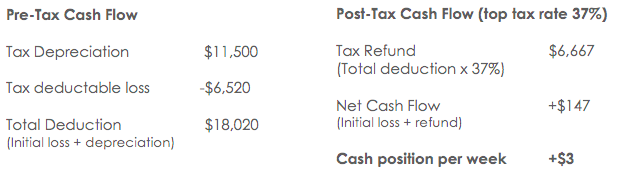

The following example shows how property depreciation will increase the cash return on an investment property. An investor owns a property purchased for $420,000 with a rental income of $490 per week resulting in a total income of $25,480 per annum. Expenses for the property such as interest, rates and management fees totalled to $32,000. Therefore the total deductable loss was $6,520. By claiming depreciation a specialist Quality Surveyor was able to turn their negative cash flow position into a positive one, saving them $4,255 for the year.

The following scenario uses the above figures to show this investor’s cash flow with and without depreciation:-

Scenario 1 – Without a Depreciation Claim:

Scenario 2 – Including an $11,500 Depreciation Claim:

This investor used property depreciation to go from a negative cash flow position, paying out $79 per week to a positive cash flow earning $3 per week on the property. Claiming property depreciation saved this investor $4,255 for the year.

How much will my Property Depreciation Schedule cost?

Wise Accountants use the services of BMT Tax Depreciation Quantity Surveyors with a special Depreciation Schedule Price of $715.00 including GST which we have passed on to our clients. BMT also guarantees to find double their fee in deductions in the first full year or there is no charge for their service. Please note that the Quantity Surveyors fees are 100% tax deductible.

Please click on the link below to download the BMT Tax Depreciation Application Form. > BMT Tax Depreciation Application Form